The Araucaria Project: Is It Still Trying to Get Away? Reply to Roy, Brecheen, Norman and Clyde

The vote was 17 to 16, with all four Republicans who initially voted to defeat the legislation — Representatives Chip Roy of Texas, Josh Brecheen of Oklahoma, Ralph Norman of South Carolina and Andrew Clyde of Georgia — voting “present.”

In a lengthy statement on social media minutes after the vote, Mr. Roy said he and the three other conservatives had secured commitments for changes to the bill that include speeding implementation of new work requirements for Medicaid and further curtailing clean energy tax credits created by the Inflation Reduction Act. He did not offer more details about either proposal, and Republican leaders provided no information on what concessions they had promised.

But Mr. Roy did say that “the bill does not yet meet the moment,” and alluded to wanting far deeper cuts to Medicaid, in a sign of the difficult path ahead. The bill will be debated by the House Rules Committee, as well as being the subject of changes that can be made before a final vote. There are two holdout members who have the ability to block its advancement from that panel.

Democrats on the Budget Committee expressed outrage at being asked to vote on legislation that was still in flux. Mr. Arrington was asked if legislators could view side agreements before casting their vote.

“Making sure all the members know transparently just what the heck is in this thing,” Mr. Boyle said, “because obviously it’s changing back in that back room by the minute.” It was an allusion to the negotiations Mr. Johnson had with the holdouts before the panel met.

The Beautiful, Big, Beautiful Bill Act: House Conservatives Identify the “Faint” $bf a Perfect Measure” Rep. J. Jayapal

Democrats are overwhelmingly opposed to the measure, which Republicans have labeled “The One, Big, Beautiful Bill Act.” In Friday’s hearing, Rep. Pramila Jayapal, D-Wash., characterized it as a beautiful betrayal.

“This spending bill is terrible, and I think the American people know that,” Rep. Jim Clyburn, D-S.C., told CNN’s “State of the Union” on Sunday. There is nothing wrong with us bringing the government in balance. But there is a problem when that balance comes on the back of working men and women. That is what is happening here.

Johnson said: “The package that we send over there will be one that was very carefully negotiated and delicately balanced, and we hope that they don’t make many modifications to it because that will ensure its passage quickly.”

If the bill passes the House this week, it would then move to the Senate, where Republican lawmakers are also eyeing changes that could make final passage in the House more difficult.

Rep. Nick LaLota, one of the New York lawmakers leading the effort to lift the cap, said they have proposed a deduction of $62,000 for single filers and $124,000 for joint filers.

Source: Trump’s bill advances in rare weekend vote as House conservatives negotiate changes

House Republicans advance a massive $Toverlinet$ tax cut and border security package in a rare weekend vote as deficit hawks negotiate changes

Johnson is not just having to address the concerns of the deficit hawks in his party. He’s also being pressured by centrists, who will be very concerned about proposed changes to Medicaid, food assistance programs and the rolling back of clean energy tax credits. Republican lawmakers from New York and elsewhere are also demanding a much large state and local tax deduction.

The Committee for a Responsible Federal Budget, a nonpartisan fiscal watchdog group, estimates that the House bill is shaping up to add roughly $3.3 trillion to the debt over the next decade.

The package permanently extends the existing income tax cuts approved by the Congress in Trump’s first term, including no taxes on tips, overtime and auto loan interest payments, and adds temporary new ones that the president advocated for in his second term. The measure also proposes big spending increases for border security and defense.

Johnson said the start date for the work requirements was designed to give states time to “retool their systems” and to “make sure that all the new laws and all the new safeguards that we’re placing can actually be enforced.”

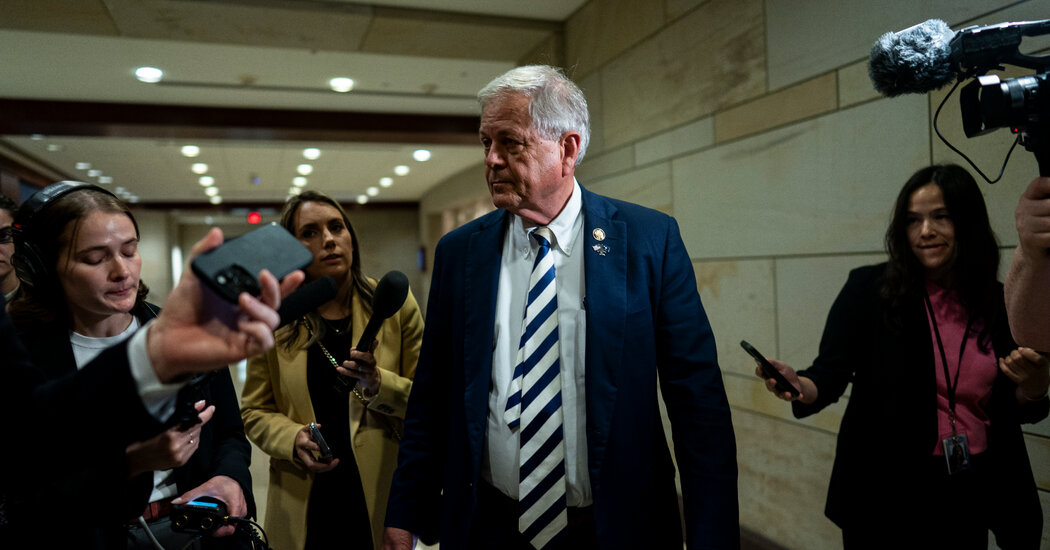

“We are writing checks we cannot cash, and our children are going to pay the price,” said Rep. Chip Roy, R-Texas, a member of the committee. “Something needs to change, or you’re not going to get my support.”

WASHINGTON — Republicans advanced their massive tax cut and border security package out of a key House committee during a rare Sunday night vote as deficit hawks who had blocked the measure two days earlier allowed it to move forward, citing what they called progress in negotiations on the package’s spending cuts.

Speaker Mike Johnson met with Republican lawmakers and told reporters some changes had been reached, but he did not give any details. He described them as “just some minor modifications. Not a huge thing.”

At this very moment, disagreements continue, according to Arrington. I think they will continue into the week and then we will put this bill on the floor of the House.

Four conservatives who have been raising concerns about the bill’s impact on the deficit voted present for the measure to advance, because they did not want it to fail.

Source: Trump’s bill advances in rare weekend vote as House conservatives negotiate changes

Reply to “Comment on Progress of the Deficiency and Tax Cuts in the House Budget’ ” by S.B. Brown et al

He said on “Fox News Sunday” that this is the vehicle through which they will deliver the mandate given to them by the American people.

The first time that Republicans tried advancing the bill out of the House Budget Committee last week, the deficit hawks joined with Democratic lawmakers in voting against reporting the measure to the full House.

The Republicans think the bill’s spending and tax cuts are front loaded and the cost is back loaded. They want to make the work requirements for Medicaid able-bodied so they can get it done quicker. The requirements would not kick in until 2029 because of the bill.